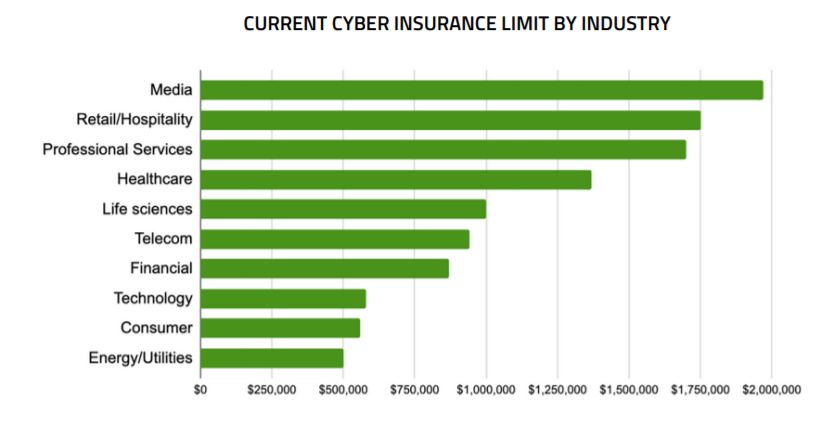

A recent survey by Cowbell Cyber revealed that 65% of SMEs are likely to spend more on cyber insurance in the next two years, compared to 58% of large enterprises. The survey report “The Economic Impact of Cyber Insurance” also found that 70% of SMEs have cyber insurance coverages with limits lesser than $1 million. The cyber insurance coverage limits varied from one sector to another. According to the report, life sciences, retail, health care, hospitality, and telecom sectors are severely under-covered with gaps in insurance limit and lose coverage.

Other notable findings include:

- 45% of SMEs and large enterprises converge on the likelihood of their business experiencing a breach in the next one year.

- 62% of SMEs in the early stages of cybersecurity maturity believe that cyber insurance is well worth the protection. Only 13% felt otherwise.

- 35% of SMEs buy cyber insurance because it is a customer requirement.

- 30% of SMEs buy insurance because of regulations requiring restitution to individuals / third-parties.

- 6 in 10 organizations plan to spend more on cybersecurity insurance over the next two years and more than half believe the cost of insurance is well worth the protection.

- On average, organizations opt for cybersecurity insurance coverage limits of about 0.14% of revenue.

- Cyberattacks using password and credential reuse cause the greatest losses today and the greatest risk over the next two years.

- Multi-Factor Authentication (MFA) is significantly under-deployed in SMEs (18%) compared to very large enterprises (43%).

- 55% of SMEs point to employee-owned end-user devices as the highest risk in two years.

“Cyber breaches are no longer an if scenario but rather a when scenario. Cyber insurance is becoming increasingly popular for SME organizations that want to protect their assets and accelerate the response and recovery process in the aftermath of a cyber incident. Cyber insurance is now a necessity and not a luxury for organizations,” said, Isabelle Dumont, VP of Market Engagement at Cowbell Cyber.

The survey findings are based on the responses from security professionals at 1,009 organizations across 13 different industries from November 2019 to January 2020. The survey helps understand the cyber insurance buying intentions, limits, and discrepancies between SMEs and large organizations in the U.S.